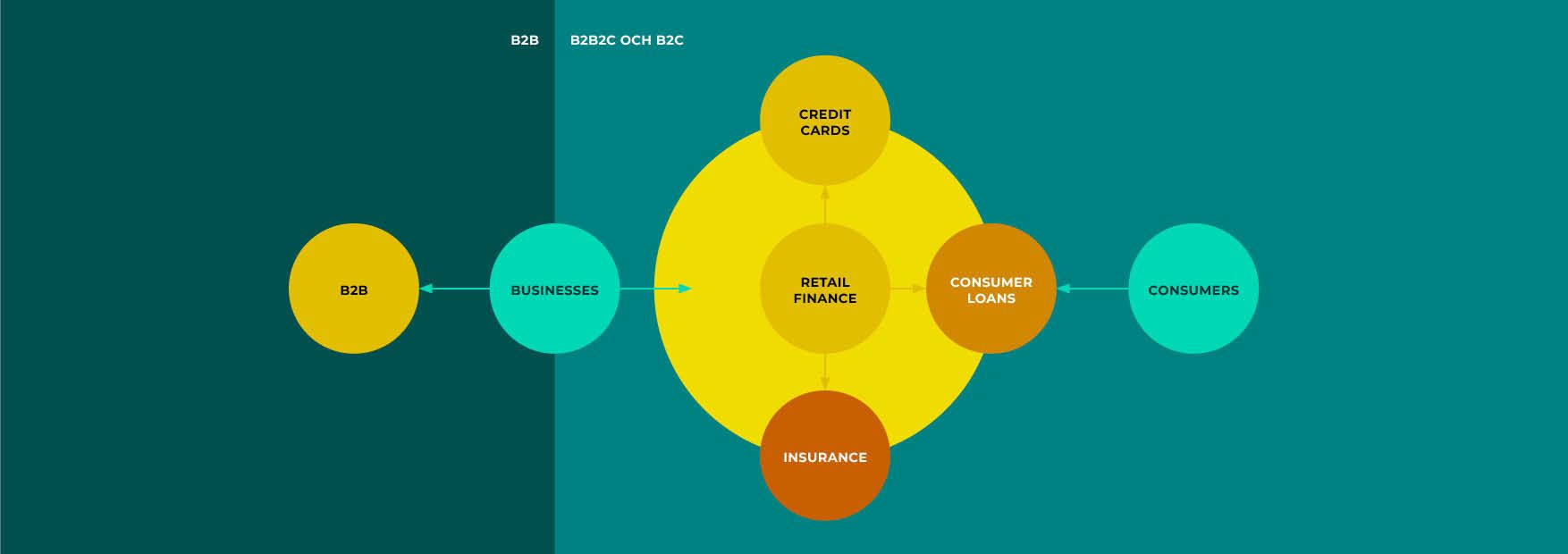

Resurs’ operations are divided into two business segments, based on the products and services offered. The Payment Solutions segment comprises the retail finance, credit cards, and B2B areas and Consumer Loans. There are important synergies between the business segments with the customer database as a common denominator, each segment develops innovative products and services that meet specific customer needs and market conditions.

The core of Resurs’ business model is the services offered to retail partners in the Retail Finance business line. Attractive payment and financing solutions for both online and offline stores build customer loyalty and increase the repurchase rate. Added value is created for consumers since they can balance income and expenses during a life cycle.

Today Resurs’ customer database contains over 6 million customers. The majority of whom first encountered Resurs via retail finance. The large customer database provides opportunity for cross-selling the Group’s other offerings.

Resurs’ strategic framework

Resurs is acting in a time when the market and society are undergoing extensive change, which also means that the industry as a whole is facing stronger external pressure regarding responsible credit lending. Modern-day customers have different expectations and requirements for us as a bank than in the past, and these are the foundation of our strategy, and transformation as we create a modern, competitive, and sustainable Resurs.